How Long Do ACH Payments Take?

ACH (Automated Clearing House) payments are a popular and efficient way to move money electronically between bank accounts in the United States. Whether you’re paying employees, receiving customer payments, or handling vendor transactions, understanding ACH timing is crucial to managing expectations and cash flow. Let’s break down how ACH payments…

Deposit Slip: What Is It and How to Fill It Easily?

Even in today’s digital-first world, there are still plenty of times when businesses and individuals need to make traditional bank deposits, especially when handling checks, money orders, or cash. That’s where the direct deposit slip comes in. If you’ve ever found yourself staring at one of those paper slips at…

Prevent Your Checks from Being Rejected: Tips for Smooth Processing

Despite the rise of digital payments, checks remain a critical part of business operations across many industries. Whether you’re paying vendors, reimbursing clients, or issuing payroll, you rely on checks and check printing software to be accurate, secure, and accepted without issue. But nothing disrupts that process faster than having…

A Quick History of Checks: From Ancient Banking to Modern Fraud Prevention

In today’s fast-paced digital economy, checks might seem like an outdated form of payment. But behind those rectangles of paper lies a rich, fascinating history — one that spans centuries, continents, and the evolution of global finance. From their humble beginnings in ancient trade to their role in today’s automated…

Understanding SOC 2 Compliance in Payment Processing

With cybersecurity threats and data privacy concerns on the rise, businesses are under increased pressure to ensure that sensitive information — especially financial data — is properly protected. For companies involved in payment processing, SOC 2 compliance has become a vital standard for demonstrating a commitment to data security, confidentiality,…

Check Payments vs. Digital Payments: Pros, Cons, and Security Differences

Nowadays, businesses have more options than ever when it comes to making and receiving payments. Two of the most common methods are traditional check payments and modern digital payments. While each has its place, understanding the pros, cons, and security differences is essential for businesses looking to optimize their payment…

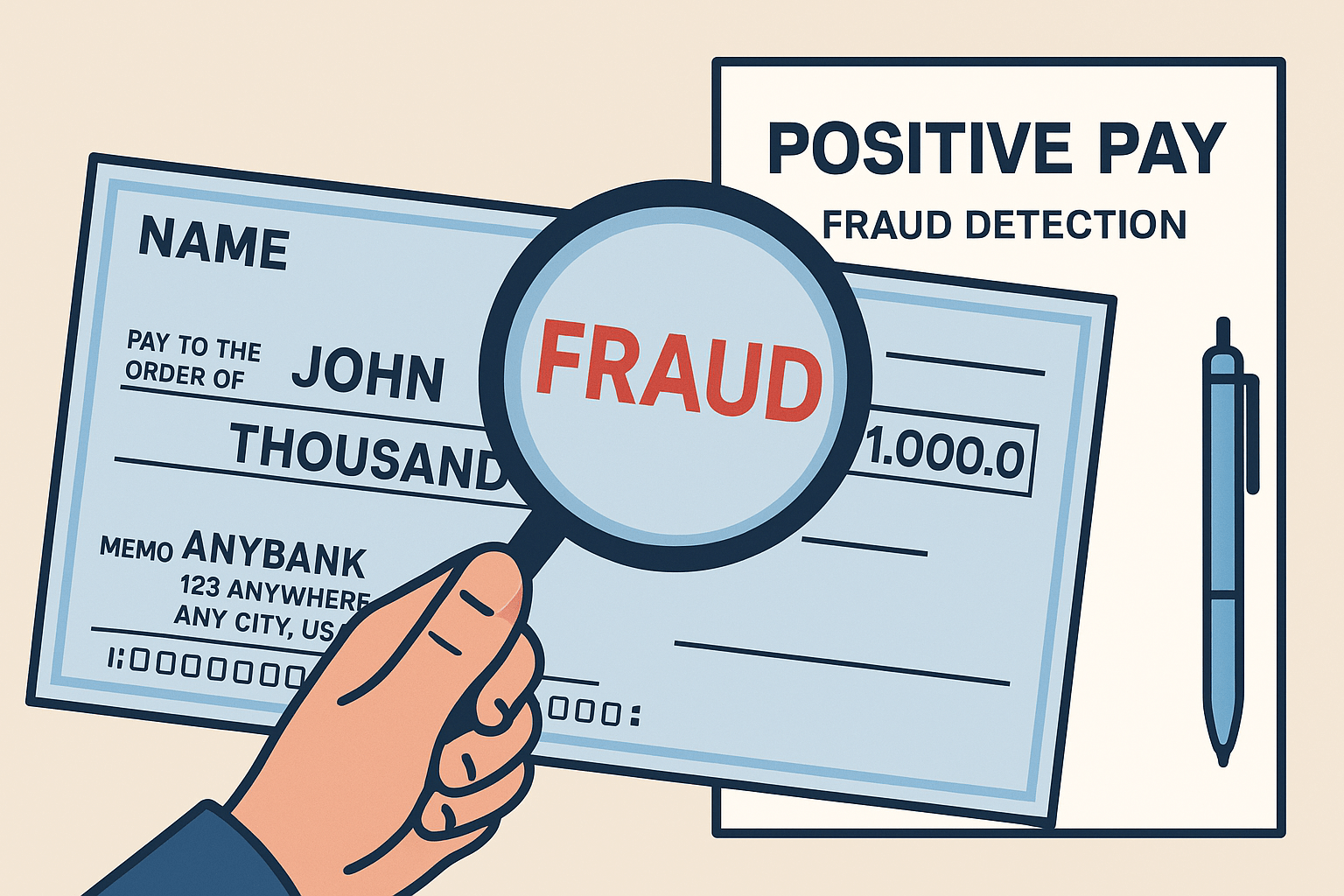

How Does Positive Pay Provide Complete Fraud Detection?

In an age where payment fraud is on the rise, businesses are constantly seeking ways to safeguard their finances. One of the most effective tools for preventing check fraud is Positive Pay. This bank-managed fraud prevention system acts as a shield, identifying unauthorized or altered checks before they’re cleared. But…

How to Prevent Check Fraud: Essential Tips for Businesses and Individuals

Despite the increasing shift toward digital payments, check mailing remains a vital payment method for many businesses and individuals. Unfortunately, they are also a prime target for fraud. Preventing check fraud requires vigilance, awareness, and the implementation of modern security measures. Here’s a comprehensive guide on how to prevent check…

How To Handle Lost or Stolen Checks Safely

Checks remain an important payment method for businesses and individuals, but they also come with certain risks, including the possibility of loss or theft. If not handled promptly and correctly, a lost or stolen check can lead to financial losses, identity theft, or fraud. This guide will walk you through…

What to Do If You Suspect Payment Fraud in Your Business

Payment fraud is an ever-present threat in the modern business landscape, costing organizations billions annually. Whether it’s unauthorized transactions, check fraud, or cyber-related schemes, quick action and preventive measures are crucial to minimizing damage. If you suspect payment fraud in your business, here’s a comprehensive guide on how to handle…